Stocks and Bonds can be exciting but are also super volatile. Discover what diversification into commercial real estate can do for your portfolio.

What We Do

Uncorrelated assets that deliver reliable

dollar-based returns and regular dividends.

We invest in buildings with long-term leases and stable, predictable income streams, in markets and sectors driven by strong fundamentals, so you can earn consistent returns.

A Generational Buying Opportunity in Commercial Real Estate

Prolonged high interest rates have created a rare window, and we believe the time is right to dive back in. Join us as we acquire premium Industrial buildings at a discount before rates drop.

Diversify Your Portfolio Today

GET STARTED NOWAccretivPLUS Healthcare Portfolio Limited and AccretivMED Real Estate Fund 1 currently own a mature portfolio of 24 buildings across 9 states, and the stable rentals from more than 100 medical tenants continue to generate regular dividends, which are distributed quarterly to investors from more than 30 countries.

AccretivPLUS Healthcare Portfolio Limited Snapshot

(As of 31 March 2025)

26

Number of Building

$22,026,569

2025 Total ProjectedRental Income

$13,438,118

2025 Projected NetOperating Income

5.59 Years

Weighted AverageLess Term

788,001 sf

Total Lettable Space

733,934 sf

Total Leased Space

93%

Occupancy Level

118

Number of TenatsThe assumptions for 2025 are based on current in-place leases and exclude new leases, sales, or acquisitions of new buildings.

- The US healthcare real estate sector offers a resilient long-term investment opportunity underpinned by strong fundamentals.

- Annual healthcare expenditures are predicted to reach $7.7 trillion by 2030, accounting for 19% of U.S. GDP

- 40% Of healthcare spend comes from Americans 65 or older, a group that makes up 18.6% of population, and this group is growing fast as boomers age.

- We invest in regions with a specific demographic and in buildings containing a mix of specialized tenants with long-term leases of at least 5 years (WALT).

We are agile and able to move quickly to capitalise on opportunities when they arise.

Small and medium bay Industrial real estate has strong fundamentals driven by the current surge of reshoring.

The ongoing manufacturing and onshoring movement is underpinned by active federal support and corporate strategy shifts. IN the first half of 2025, over $1.7 trillion of new investment has been pledged, and this will continue to fuel demand for U.S. industrial real estate.

Investors can expect consistent occupancy, growing rents, and competitive total returns in this segment, making it a staple for diversified real estate portfolios and a key beneficiary of America’s industrial revival.

We are capitalising on this huge market opportunity with our first three acquisitions for the portfolio, expected to close before the end of 2025.

Monitor and Transact 24/7

Our user-friendly platform makes it easy for you to manage your investment, wherever you are, 24 hours a day and seven days a week.

Within a secure online environment, you can track your returns, invest and withdraw funds.

If you need hands-on assistance, your dedicated relationship manager is always available to answer your questions about your properties and transactions.

Our offerings in the USA are filed with the SEC under Regulation D, 506(c) or Regulation 506 (b) and Regulation A+.

If you are an investor who can invest directly from the United States, please visit our US Platform.

For global investors, our offerings are listed on the MERJ exchange and regulated by the Seychelles Financial Services Authority.

OrbVest SA (Pty) Limited is an authorised financial services provider in South Africa (licence no 50483) and an approved referring broker on the MERJ Exchange.

For more, please look at our Terms and Conditions.

Commercial Building Across the U.S.

Investors from over 30 Countries

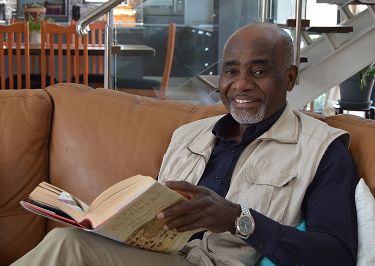

Manu Wope

“By being hyper-focused on the trending and resilient medical segment of the US real estate sector, OrbVest and its capable team offer prospective investors and in particular those non-US residents, a trusted and highly simplified means to successfully take advantage of the ageing baby boomers cycle, hedge forex risk and bag consistent dividends … I took the ride and became a repeat investor.”

Basil & Nicki Bowles

“A real investment gem! I am delighted to have found this opportunity, because it meets my need for a solid offshore investment that pays out a regular income. Being able to view my portfolio and transact online is comforting and convenient. I have invested and reinvested in OrbVest buildings for three years now and I’ve never been disappointed.”

Sally Lynne Oosthuyse

“A real investment gem! I am delighted to have found this opportunity, because it meets my need for a solid offshore investment that pays out a regular income. Being able to view my portfolio and transact online is comforting and convenient. I have invested and reinvested in OrbVest buildings for three years now and I’ve never been disappointed.”