Q4 2020 MARKET UPDATE

MARKET TRENDS:

The year 2020 will be remembered for the impact of Covid-19. The number of visits to certain types of facilities, mostly elective-use practices, and dentists plummeted. In stark contrast, critical use facilities, specifically off-campus, experienced a surge of patient visits.

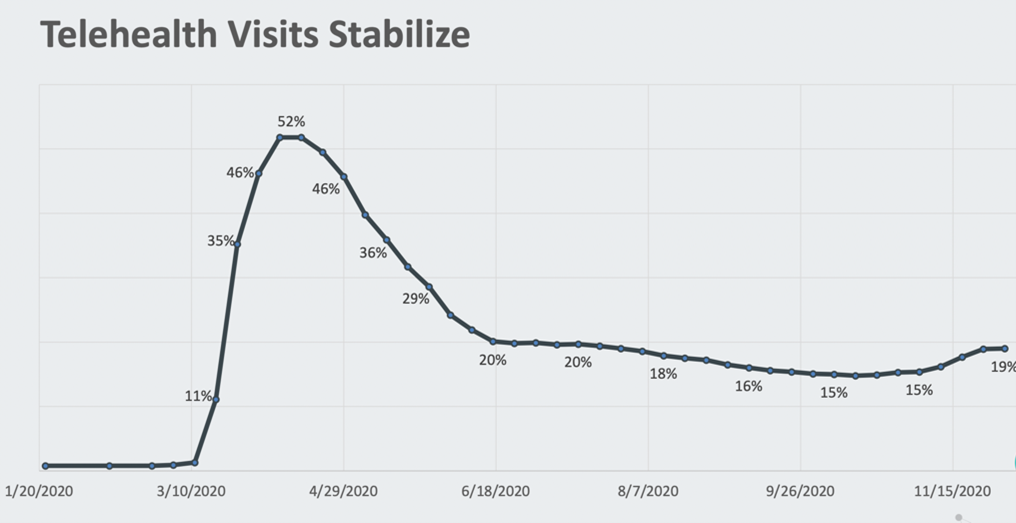

We have also noticed increased usage of telehealth. According to data from the U.S. Centers for Medicare & Medicaid Services, an average of 14,000 beneficiaries per week received telehealth services last year. Between mid-March and early July, after the onset of Covid-19, that figure shot up to 10.1 million beneficiaries per week.

Figure 1 - Telehealth Visits

In response to the pandemic, the federal government adjusted payment plan policy and regulations to support greater access to telehealth. They took a pilot program introduced last year that paid for some rural residents to virtually visit their doctor and expanded it nationwide. The adoption is still not as widespread as anticipated, as tele- visits declined substantially after the Covid-19 peak in Q1/Q2. Specialty's telehealth visits paint a fascinating picture.

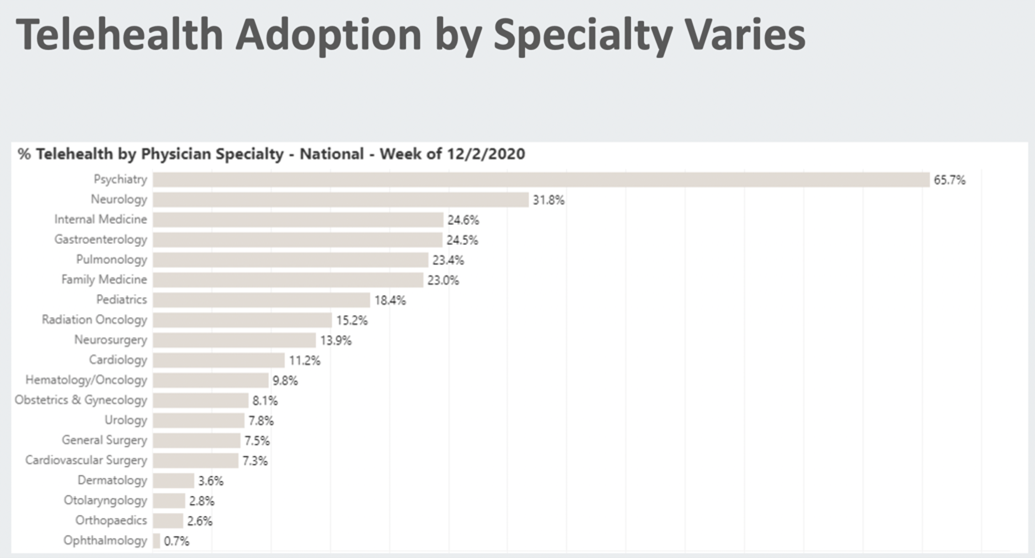

Figure 2 - Telehealth by Specialty

They illustrate what we call "light" and "heavy medical" in terms of the type of medical specialty. The "heavy medical" is the more installation-intensive centers like surgery and they are reflected in the figures towards the bottom of the graph.

OrbVest’s acquisition strategy is to focus on buildings with more "heavy medical", where possible. Medical office construction may also gain some momentum in 2021. Despite a construction slowdown due to the pandemic, the sector delivered more than 2.8 million square feet in the second quarter of 2020. On a national basis, vacancy rates climbed 20 basis points to 8.9% this year, but that stands in sharp contrast to the 13.6% vacancy rate for traditional office space.

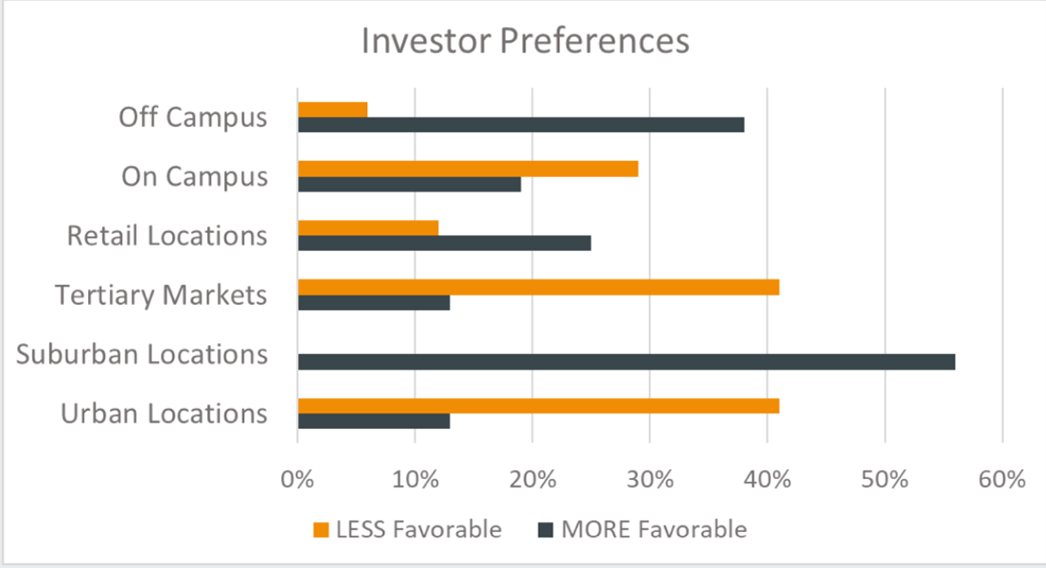

Rental growth in the medical office sector also maintained its upward trajectory, rising by 9% over the last year to a second-quarter average of $25.22 per square foot. All in all, the outlook for this sector is good. We have also noted investors’ preference for more off-campus investment and more in suburban locations. This seems to be a direct reflection of people working from home and preferring to be in closer proximity to residential areas. Secondly, there is a perception that a smaller center has less infection risk than a large hospital or medical facilities.

Figure 3 - Real Estate Investor Preference changes - source Revista

OVERALL STATE OF THE MEDICAL OFFICE MARKET:

The Medical Office Market remains very resilient and the steady occupancy and year-on-year rental growth can be seen in Figure 4.

Figure 4 - MOB fundamentals

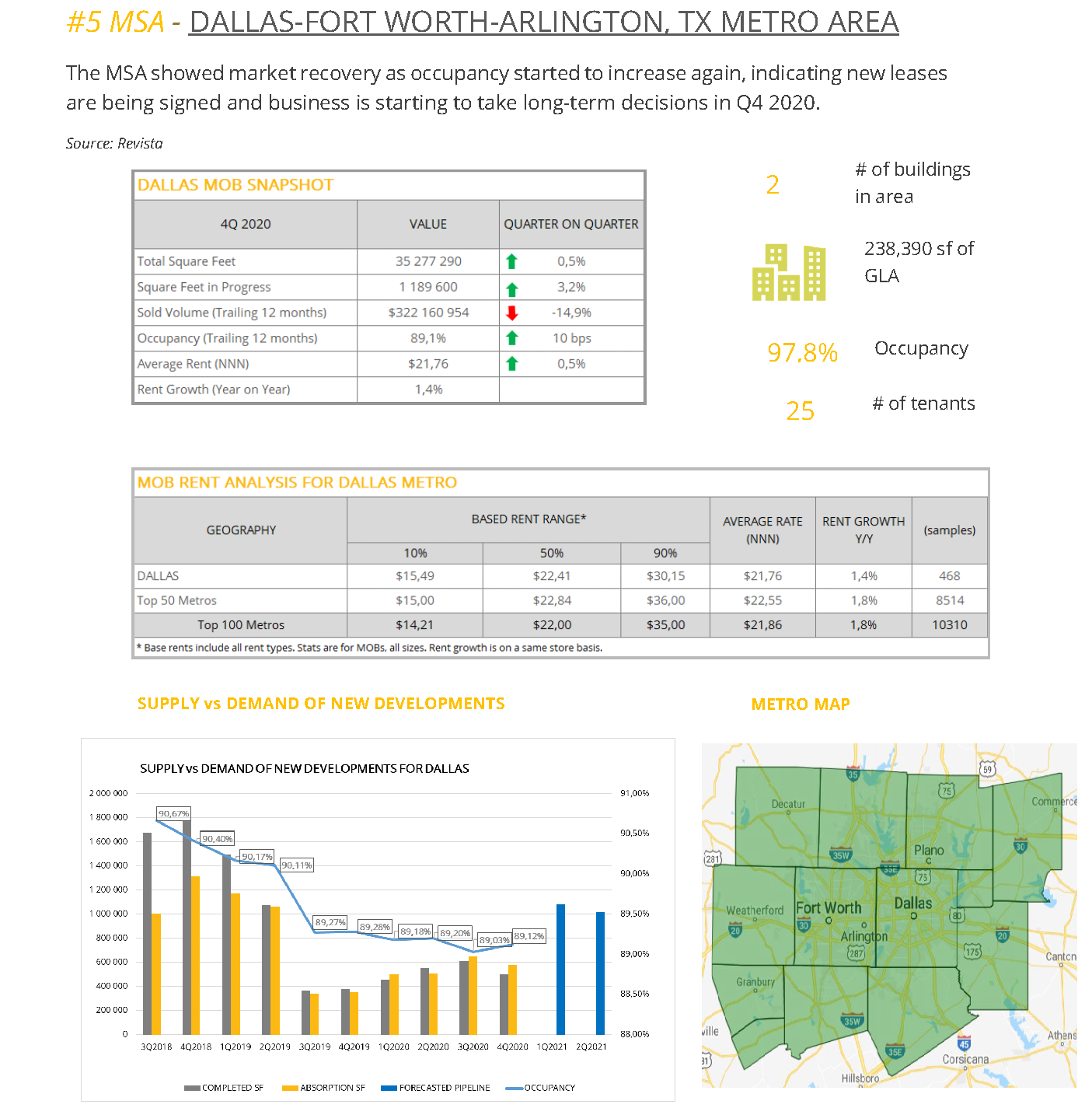

OrbVest’s acquisition strategy is reflected in the investments it has secured in these very active markets (Figure 5): Atlanta, Dallas, Phoenix, San Diego and New York. With the new president, we expect changes to tax laws that will affect real estate investments. Notably, there was an election promise to increase capital gains tax. The exact impact will only be known once the specific proposals are tabled, but we do not expect a material change to investor returns.

Figure 5: Most Active Market – source Revista

CONCLUSION:

The medical real estate sector has shown overall steady growth and there has been a marked turnaround within the submarket in which Orbvest has investments. Refer to details in the submarket review below. The industry has adapted well to the pandemic and is now stabilizing and growing further. The vaccine roll-out is progressing quickly and will help to restore the environment to normal. Source: Revista – Q4 2020 update, National Real Estate Investor, JLL.

MARKET DATA - REFERENCE:

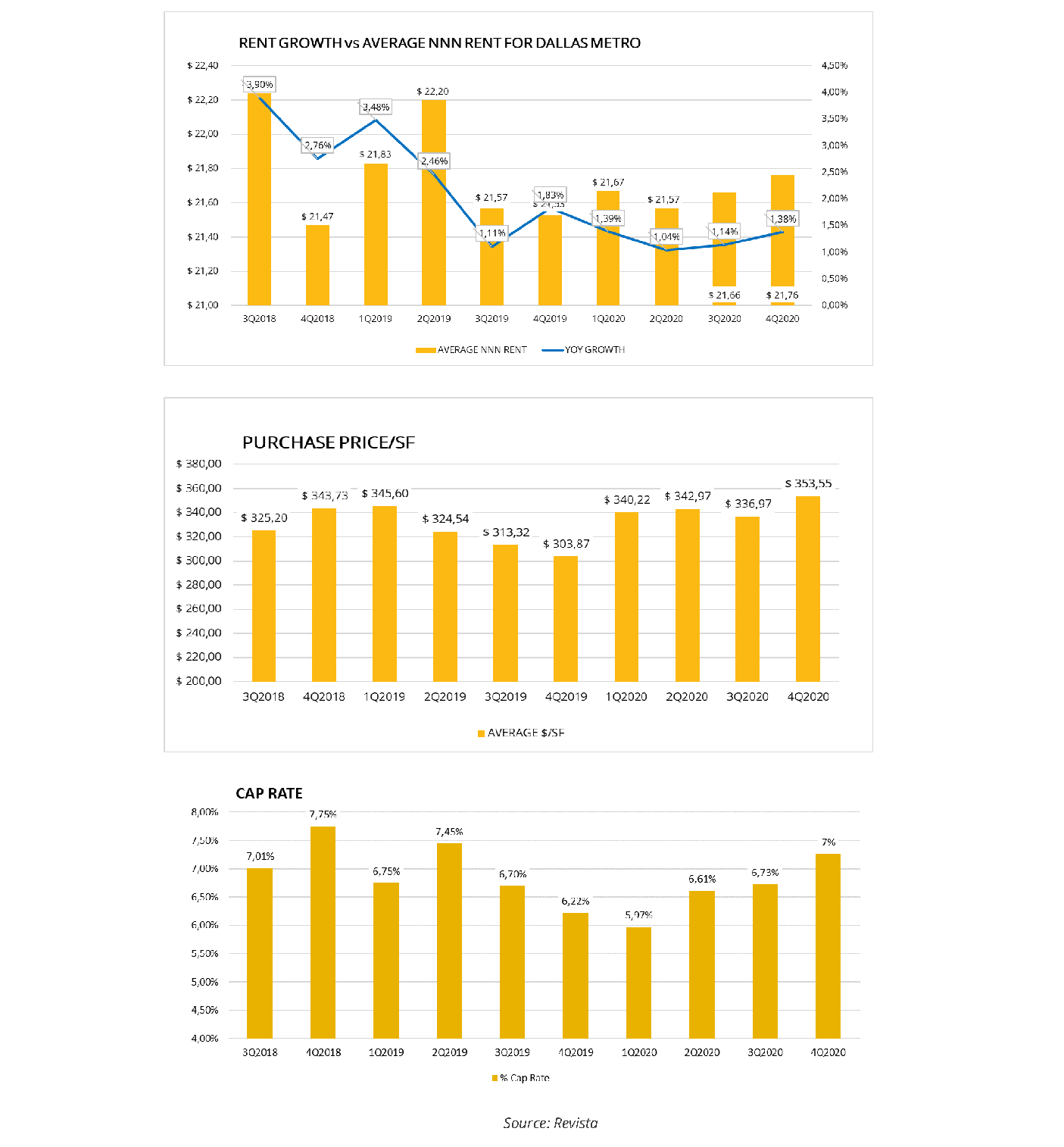

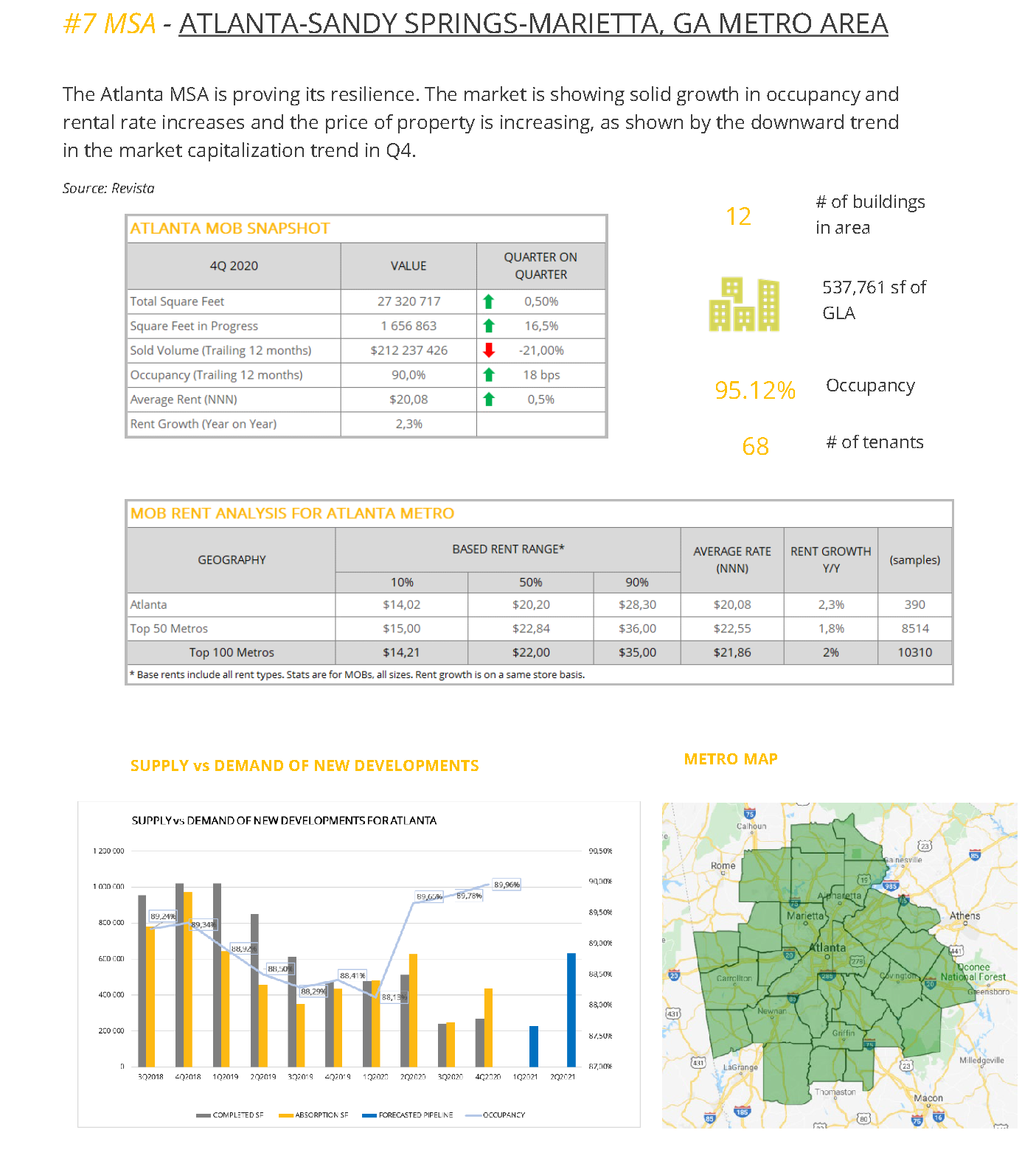

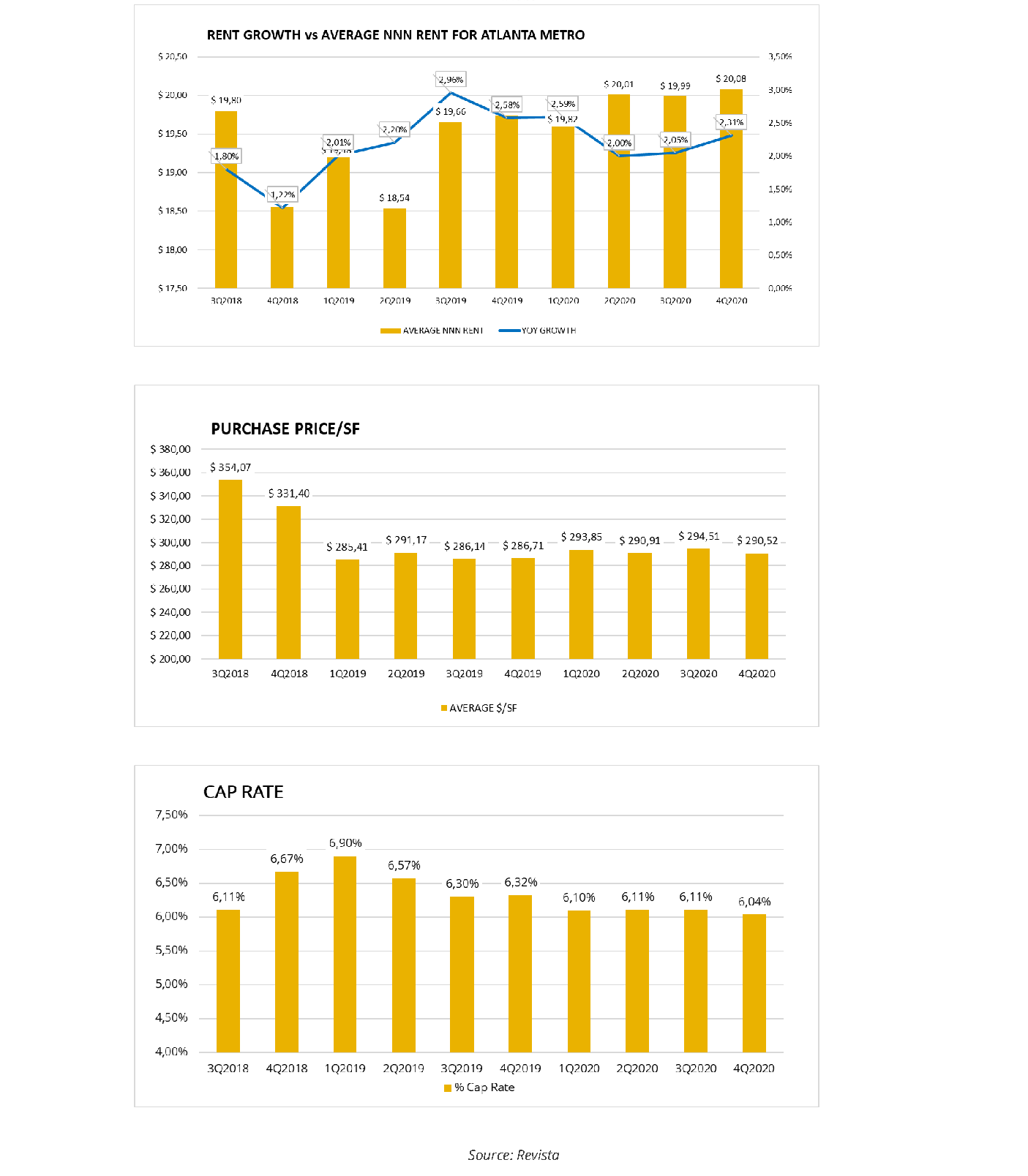

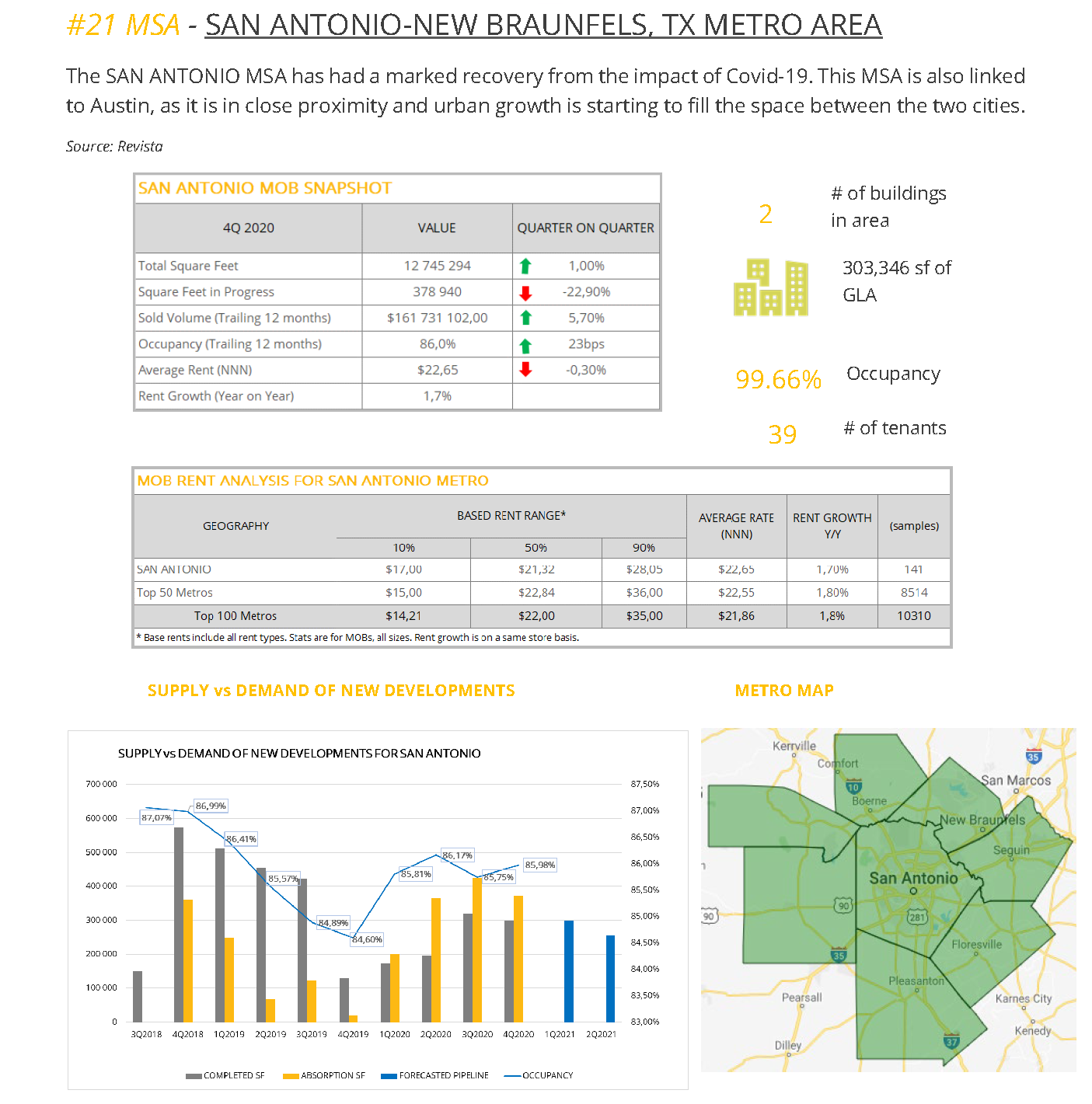

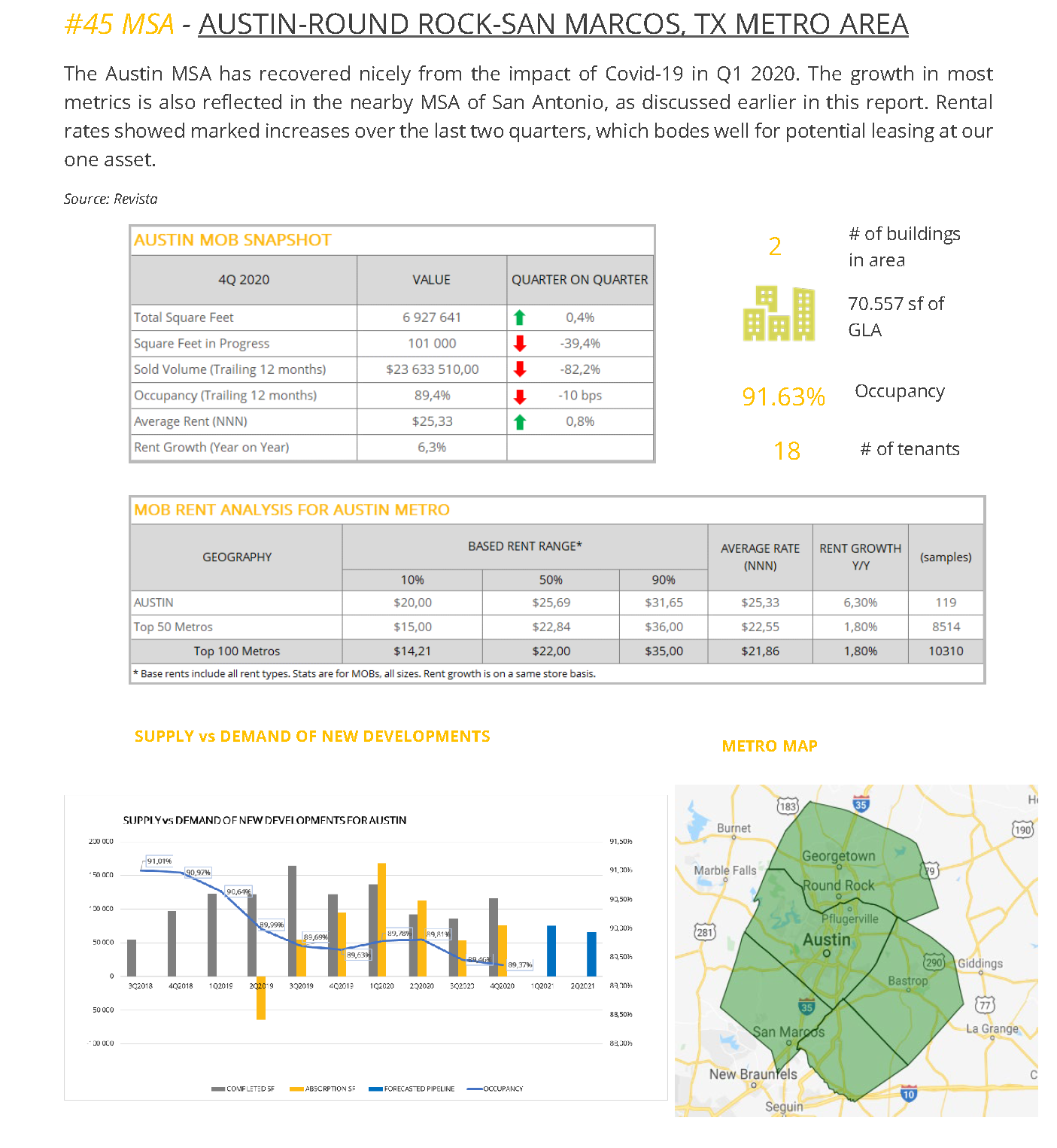

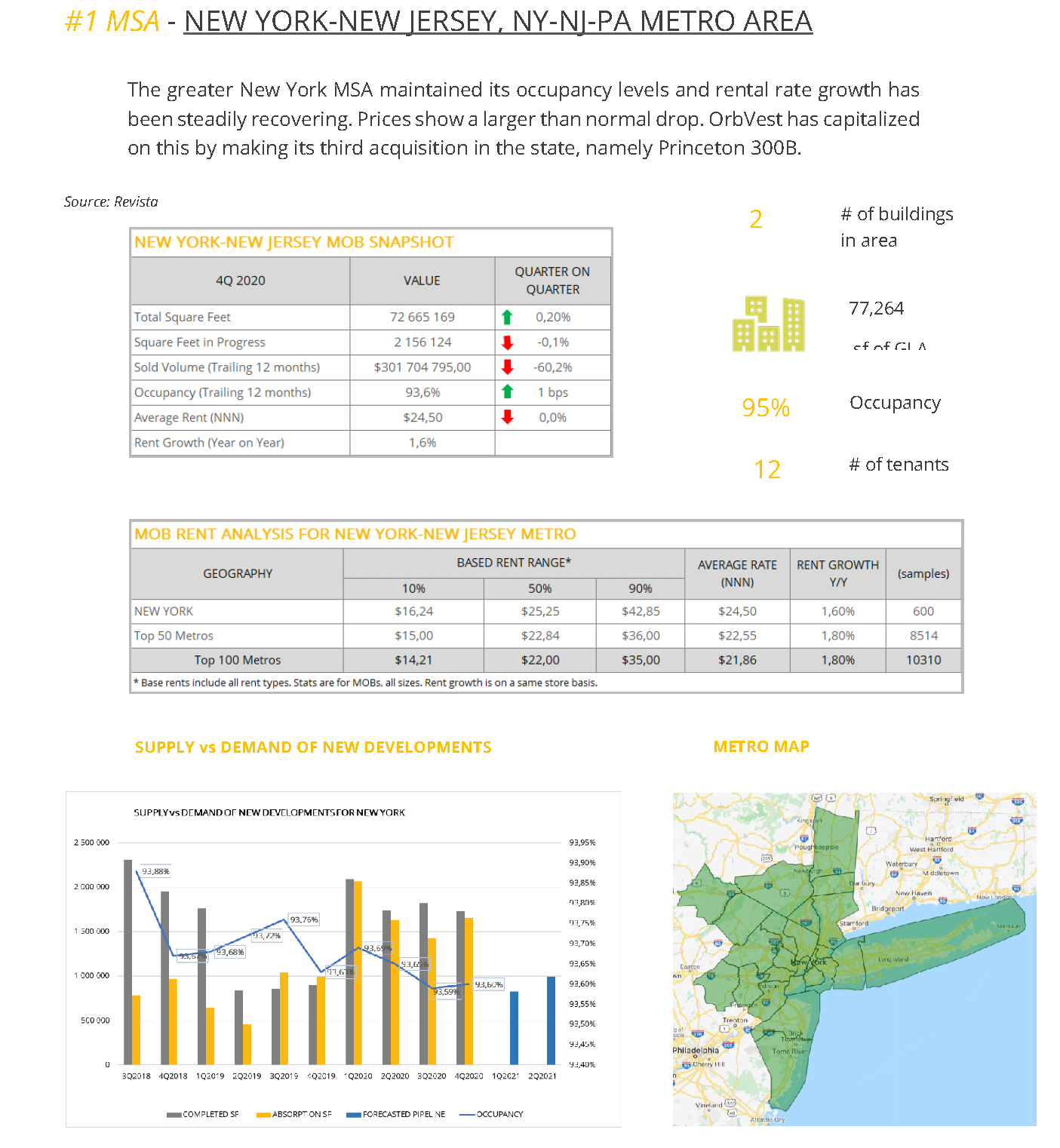

The 4 Metro reports from Revista, covering areas in which Orbvest is managing assets, have been added as a reference below. The data reflects the period in Q4 2020 that shows the recovery in the market post Covid-19. As can be seen below, the impact of Covid-19 reflects differently in each Metro and make for very interesting reading.

DISCLAIMER:

The content and information herein contained and being distributed by Orbvest are for information purposes only and should not be construed, under any circumstances, by implication or otherwise, as advice of any kind or nature, or as an offer to sell or a solicitation to buy or sell or to invest in any securities or currencies herein named. The information was obtained from sources believed to be reliable but is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Past performance does not guarantee future performance. Any market data or information used herein is for illustrative and informational purposes only. Please get the advice of a competent advisor before investing your money in any financial instrument or product and it is your responsibility to obtain the necessary legal, tax, investment, financial or any other type of advice in this regard.

SOURCES: REVISTA, WALL STREET JOURNAL, AVISON YOUNG RESEARCH, BLOOMBERG, DALLASFED.ORG AND U.S. BUREAU OF LABOR STATISTICS LATEST NUMBERS.