Q3 2020 MARKET UPDATE

OVERALL MARKET VIEW:

The OrbVest Investment Committee and Acquisition team have been monitoring the Medical Real Estate medical transactional data and trends very closely over the past few quarters.

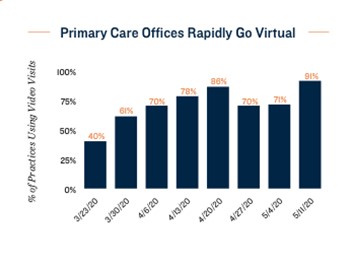

One of the trends that we are monitoring closely is the impact of telemedicine in the USA and how this may impact our acquisition strategy. As can be seen below, patients are increasingly making use of virtual visits, but still prefer actual ‘in person’ visits.

During COVID patients with chronic conditions have been monitored by doctors over virtual channels. Many medicines still cannot be prescribed online as it is restricted by law. Some forms of healthcare are more adaptable to online settings, like behavioural health service, though the need for in-person visits, labs and imaging will sustain demand for medical office buildings.

- Medical office sales remained strong over the 12-month period in June with transactions dipping just 2 percent. Strong investor interest led medical offices to account for 19 percent of overall office volume in the second quarter, up considerably from the 7 percent average.

- Transaction velocity was headlined by the Southeast region, an area of greater in-migration among the older cohorts in recent years. The average cap rate reseed in the low-7 percent band.

- Pricing averaged just above $259 per square foot over the past four quarters, a modest 1.9 percent increase from the prior year-long stretch.

- Medical campus and hospital expansions continue to draw REITs and institutional buyers to proximate office assets. Cap rates for newer buildings in these districts begin in the mid-4 percent range.

- Despite a major pullback in projects underway in the second quarter, more than 2.8 million square feet was delivered, bringing the year-long total to just above 10 million square feet. Deliveries were down by almost 1 million square feet from the prior period. Moving forward, more projects will be shelved, which should help to stabilize the sector and prevent oversupply risks.

- The economic challenges and elimination of major revenue streams experienced by care providers have placed pressure on tenants to reduce expenses and reconsider space requirements. Some health systems may allow a greater share of administrative staff to work remotely going forward, which could bring more sublet space onto the market. Underlying demand factors, including the growing need for healthcare services, overshadow the immediate impacts of the pandemic.

- On a national basis, vacancy climbed to 8.9 percent in the second quarter, a 40-basis-point climb from the same time last year. Net absorption fell by roughly half over the past 12 months in contrast with the prior period, in large part due to limited availability and the shortage of modern and upgraded facilities.

- A hit to revenue for many tenants has led some to seek deferrals and rent relief, though most REITs have reported strong rent collections, an indication that many operators have been able to weather the worst of the crisis. Small businesses in the healthcare sector often have greater cash reserves than those impacted in other industries, preventing a wave of business closures.

- Amid the current turmoil, rent growth maintained an upward trajectory over the past four quarters, reaching an average of $25.22 per square foot.

CONCLUSION:

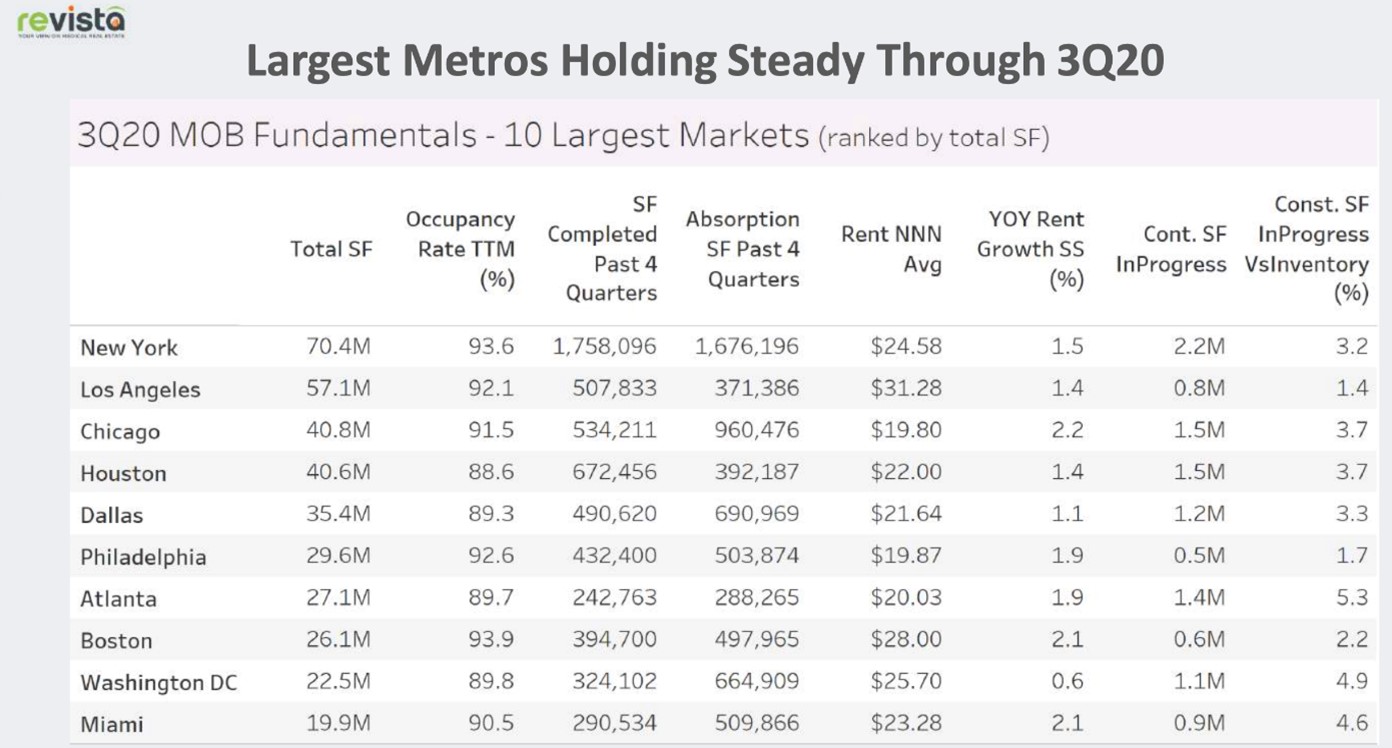

The MOB fundamental remains strong as can be seen by the Revista table above in the largest Metros. The 2Q to 3Q has seen recovery and growth as the asset class attracts new capital and further confirms the resilience of the Medical Real Estate Asset Class. Transaction volumes are consistent with prior year and pricing remains high. Construction picked up in Q3 increasingly moving off campus.

Source: Revista – Q3 2020 update, Marcus and Millichap – Beyond the global Health Crisis

Market Data - Reference

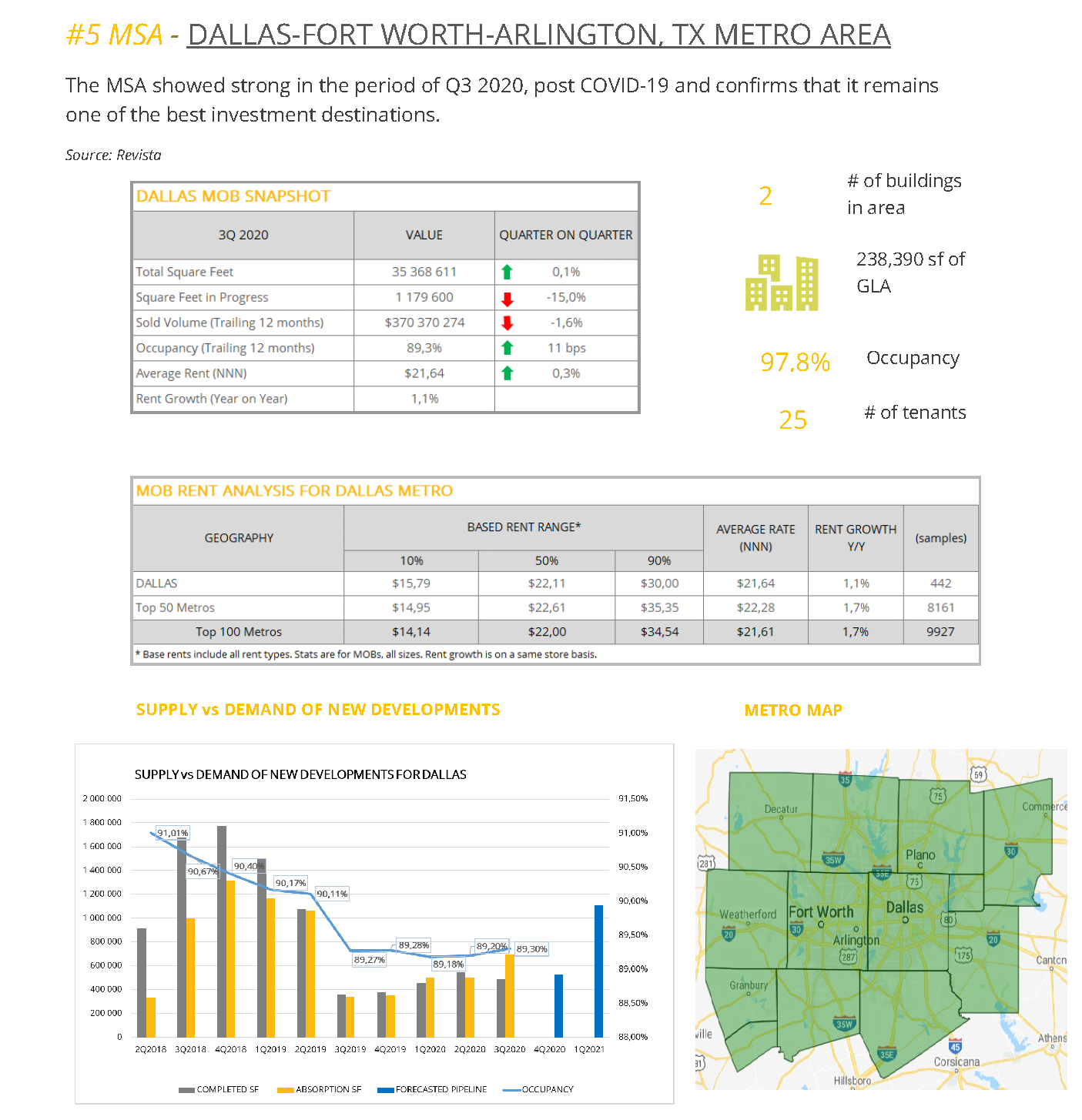

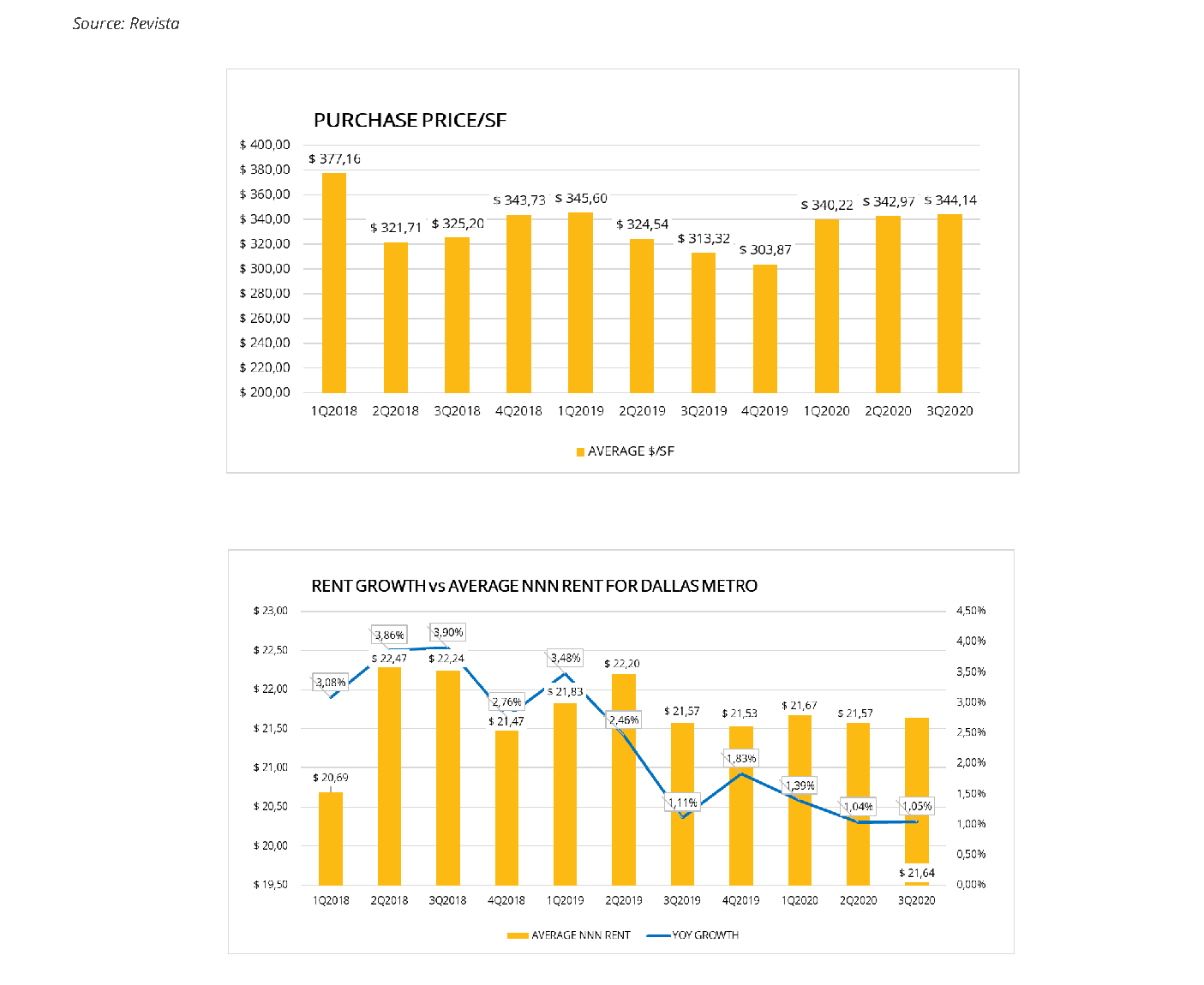

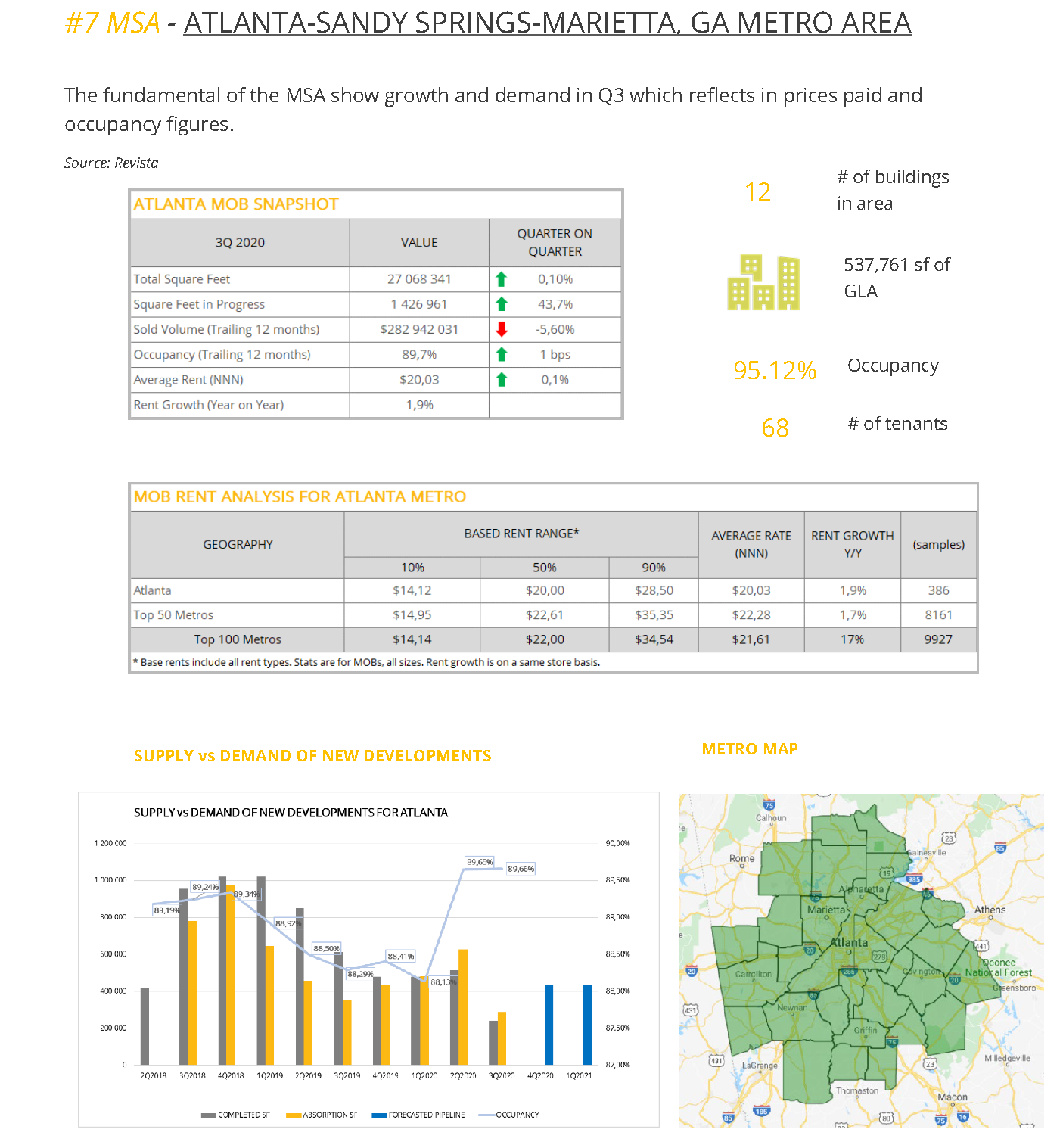

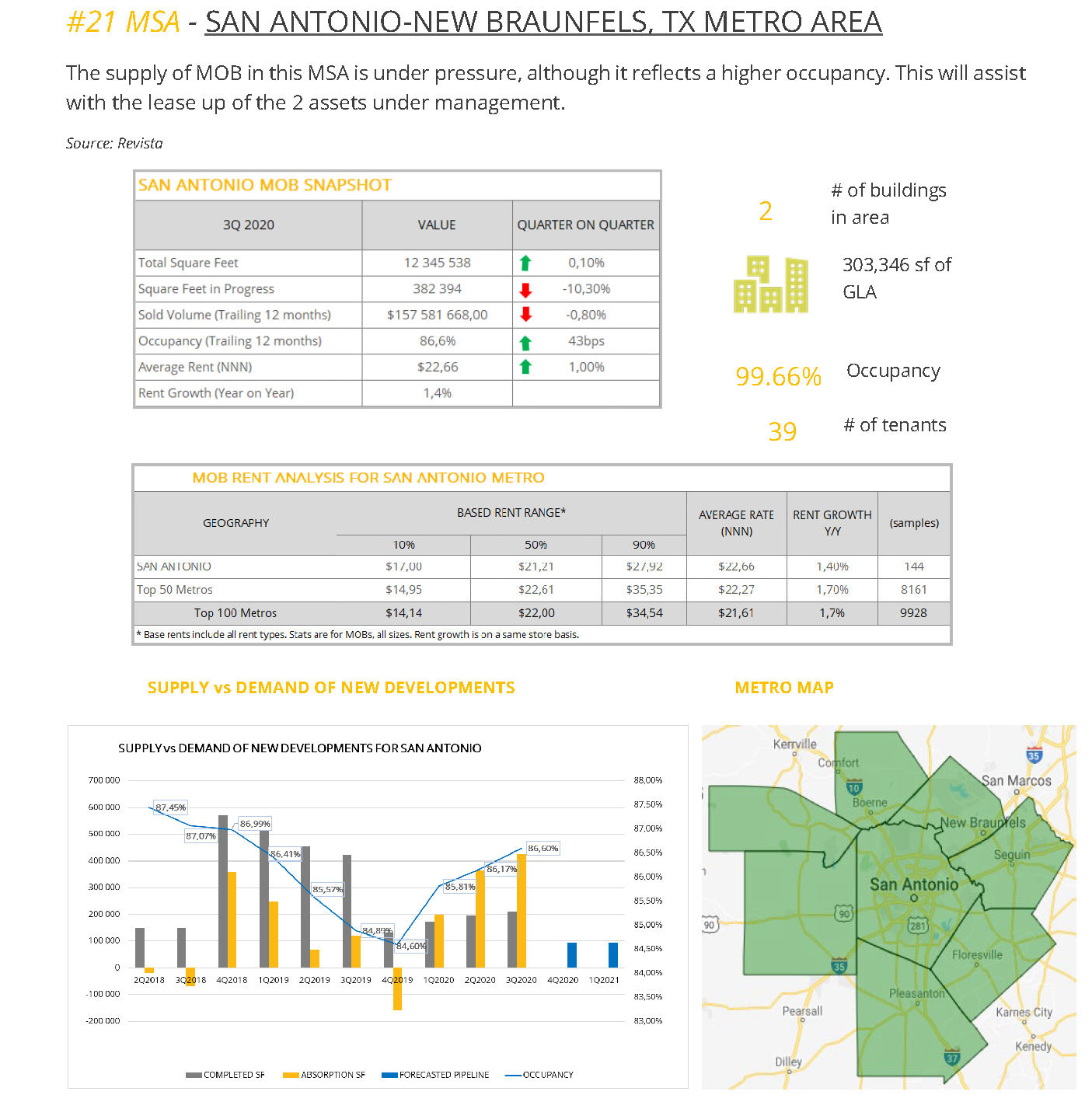

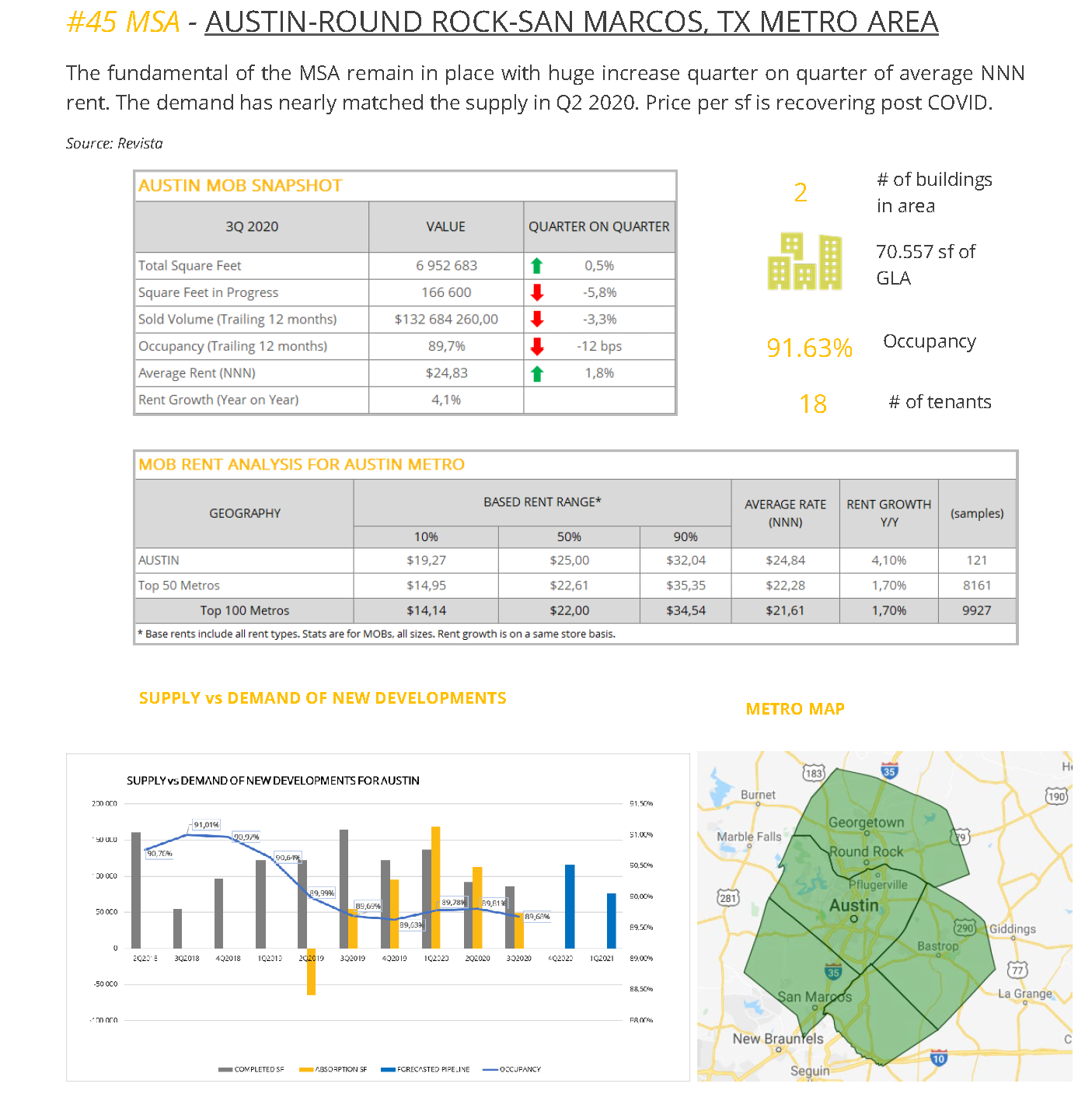

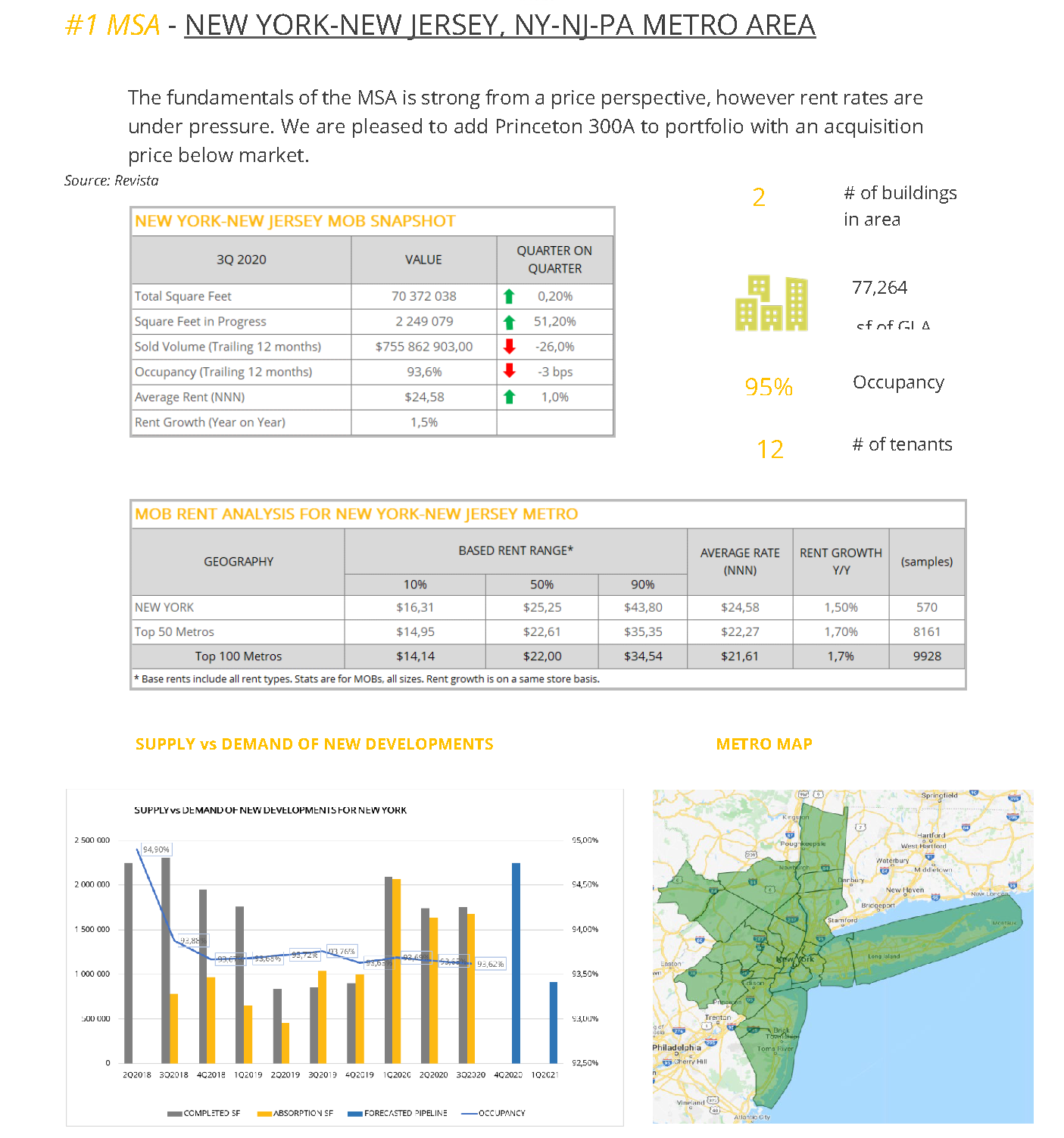

The 4 Metro reports, from Revista, in which Orbvest are managing assets, have been added as a reference below. The data reflects the period of Q3 2020 that shows the recovery in the market post COVID-19. As can be seen below, the impact of COVID-19 reflects differently in each Metro and make for very interesting reading.

DISCLAIMER:

The content and information herein contained and being distributed by Orbvest are for information purposes only and should not to be construed, under any circumstances, by implication or otherwise, as advice of any kind or nature, or as an offer to sell or a solicitation to buy or sell or to invest in any securities or currencies herein named. The information was obtained from sources believed to be reliable but is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Past performance does not guarantee future performance.

Any market data or information used herein is for illustrative and informational purposes only. Please get the advice of a competent advisor before investing your money in any financial instrument or product and it is your responsibility to obtain the necessary legal, tax, investment, financial or any other type of advice in this regard.

Sources: REVISTA, WALL STREET JOURNAL, AVISON YOUNG RESEARCH, BLOOMBERG, DALLASFED.ORG AND U.S. BUREAU OF LABOR STATISTICS LATEST NUMBERS, MARCUS AND MILLICHAP.